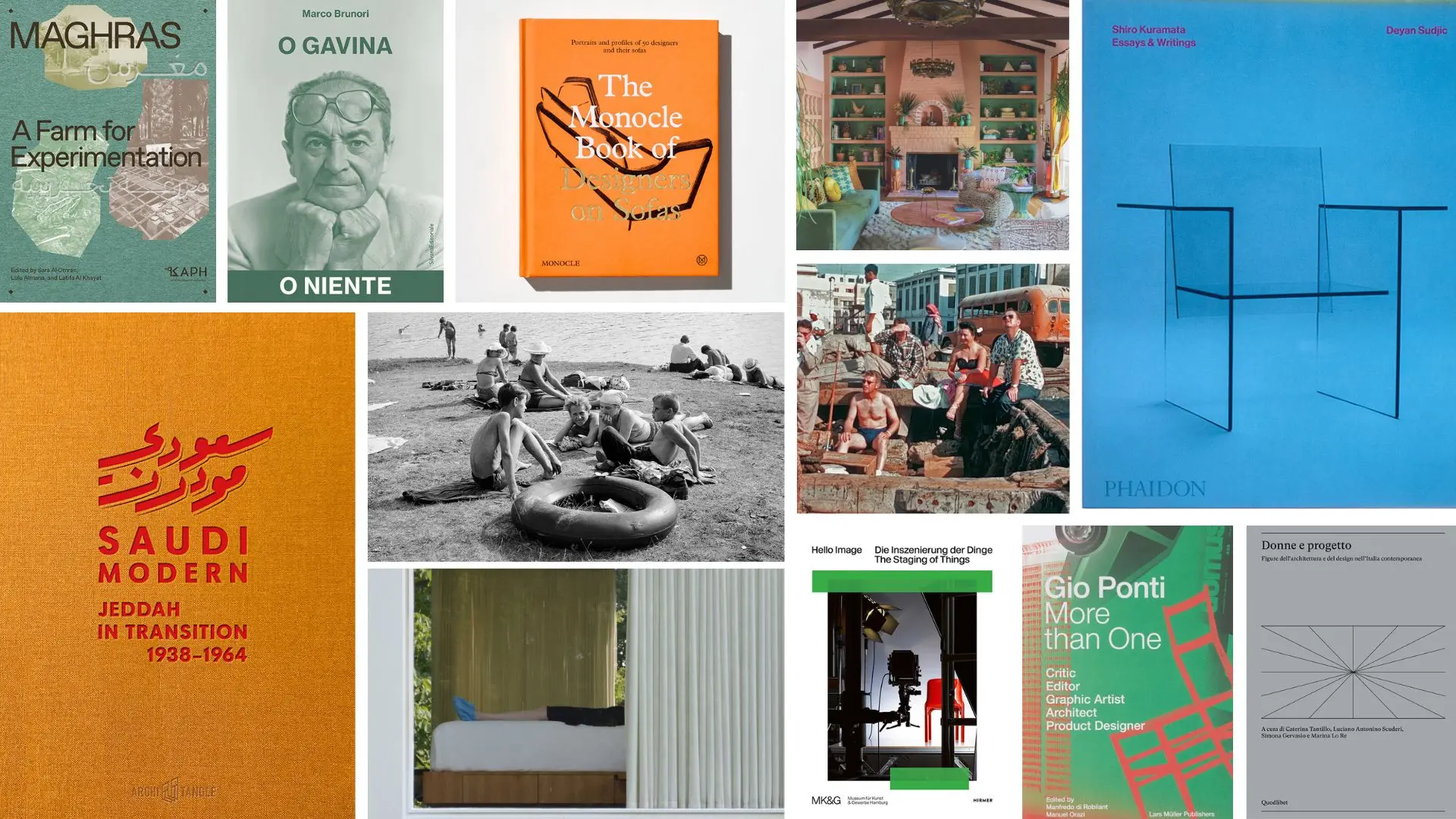

A journey through women’s interior design, three iconic monographs and the links between design, photography and marketing, up to the transformation of Jeddah, social innovation and a reportage by Branzi and... 50 designers on the sofa

Furniture bonus 2025: how it works and how to make the most of it

The discount for furnishings and appliances should be confirmed, but beware of restrictions on bonuses for the home (and restructurings). Here is the guide to the incentives

The furniture bonus for the purchase of furniture and large appliances should also be extended in 2025. The conditional mood is necessary because the measure is contained in the budget that has to pass the test of Parliament.

Furniture bonus 2025: amount and requirements

According to the provisions of the 2025 Budget Law, the Furniture and Appliances Bonus will be extended for the year to come without further reductions. This means that it should be confirmed for coming year in the same form as in 2024. The discount applied will remain the same: 50% on a maximum of 5,000 euros of expenditure on furniture and large appliances intended for a property undergoing restructuring.

Electric and kitchen appliances

The website of the Tax Agency, remember, has defined the bonus for 2024 as a “50% tax deduction for the purchase of furniture and large class A appliances for ovens, class E for washing machines, washer-dryers and dishwashers, class F for refrigerators and freezers intended to furnish a property undergoing restructuring”. Based on the rules for the current year, large household appliances should include, for example, refrigerators, freezers, washing machines, washer-dryers, dryers, dishwashers, cooking appliances, electric stoves, electric hot plates, microwave ovens, electric heating appliances, electric radiators, electric fans, air conditioning appliances.

Which furnishings?

The Tax Agency also explains that beds, wardrobes, chests of drawers, bookcases, desks, tables, chairs, bedside tables, sofas, armchairs, sideboards, as well as mattresses and lighting appliances, except doors, flooring, curtains and drapes are among the eligible furnishings.

2025 furniture bonus: how it works

As anticipated here, the discount remains at 50% and currently has a ceiling of expenditure of 5000 euros. This is a figure that has been reduced over the years. It have gone from 10000 euros in 2022 to 8000 euros in 2023. Numbers aside, there are two important innovations. We know that the Home Bonuses will be reduced and will be part of the new ceiling for deductible expenses. These will be subject to factors such as income and the number of children, based on the principles of the family quotient. The Furniture Bonus will also be part of the new ceiling for deductible expenses and this could reduce the actual amount of the deduction available.

How to pay: immediate discount, on the invoice or by bank transfer?

Turning to the most critical factor, payment, first of all it must be remembered that the costs of transport and assembly of the purchased goods can also be considered, as long as the expenses themselves have been incurred with the payment methods required to benefit from the deduction. What are they? Only payment by bank transfer or debit or credit card are permitted. There is no immediate or invoice discount, nor is it permitted to pay by bank check, cash or other means. The deduction is also valid if payment is made by an instalment loan, provided that the company providing the loan pays the sum in the same way as indicated above and the taxpayer has a copy of the payment receipt. Therefore, the closest attention should be paid to the documents to be kept (the proof of payment and the invoices of the goods specifying the nature, quality and quantity of the goods and services purchased). Obviously, a receipt that shows the buyer’s tax code, together with the specifications just listed, will be equally fine. Finally, the Tax Agency for last year recalled that by complying with all these requirements, the deduction can also be used for purchases made abroad.

Bonus without restructuring?

In a nutshell: no. As already seen, the bonus for the purchase of furniture and large appliances (if the deduction is confirmed for 2025 in the same way it was in force in 2024) is permitted only if they are intended to furnish a property undergoing restructuring, so the start date of the work will have to be proven. We know that until now the taxpayer who has carried out restructuring work on buildings has been entitled to the bonus several times, and a confirmation of this aspect is assumed. So we must again talk about the Home Bonus, under which the upgrading of the first home will continue with the 50% tax discount, while second homes will undergo a reduction to 36%. This means that it is advisable to pay attention to the bonuses related to the restructuring of second homes: in fact, you can take advantage of a 36% discount on the work (Home Bonus) and 50% on the purchase of furniture and appliances (Furniture Bonus).

Finally, it is advisable to remember that you will only be able to take advantage of the Furniture Bonus if you start restructuring work before buying the furniture and large appliances.

Markets

Markets